MGM Resorts Raises $750 Million Through Senior Notes Offering

2 minutos de lectura

(Las Vegas).- MGM Resorts International announced that it has priced a public offering of $750,000,000 in aggregate principal amount of 6.500% senior notes due 2032 at par. The transaction is expected to close on April 9, 2024, subject to customary closing conditions.

The company intends to use the net proceeds from the offering of the notes to repay existing indebtedness, including its outstanding 6.750% senior notes due 2025. Pending such use, the firm may invest the net proceeds in short-term interest-bearing accounts, securities or similar investments.

The notes being offered will be general unsecured senior obligations of the Company, guaranteed by substantially all of the Company's wholly owned domestic subsidiaries that guarantee the Company's other senior indebtedness, and equal in right of payment with all existing or future senior unsecured indebtedness of the Company and each guarantor.

Deutsche Bank Securities Inc., BofA Securities, Inc., Barclays Capital Inc., BNP Paribas Securities Corp., Citigroup Global Markets Inc., Citizens JMP Securities, LLC, Fifth Third Securities, Inc., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, Scotia Capital (USA) Inc., SMBC Nikko Securities America, Inc., and Truist Securities, Inc. will act as joint book-running managers and Goldman Sachs & Co. LLC, PNC Capital Markets LLC, U.S. Bancorp Investments, Inc., and Wells Fargo Securities, LLC will act as co-managers for the proposed offering.

Categoría:Others

Tags: Sin tags

País: United States

Región: North America

Event

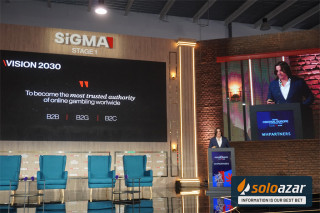

SiGMA Central Europe

03 de November 2025

SiGMA Central Europe 2025 Closes First Edition with High Attendance and Roman-Inspired Experiences

(Rome, Exclusive SoloAzar) - The first edition of SiGMA Central Europe in Rome came to a close, leaving a strong impression on the iGaming industry. With thousands of attendees, six pavilions brimming with innovation, and an atmosphere that paid homage to Roman history, the event combined spectacle, networking, and business opportunities. It also yielded key lessons for future editions.

Friday 07 Nov 2025 / 12:00

Innovation, Investment, and AI Take Center Stage on Day 3 of SiGMA Central Europe

(Rome, SoloAzar Exclusive).- November 6 marks the final and most dynamic day of SiGMA Central Europe 2025, with a packed agenda that blends cutting-edge tech, startup energy, and investor engagement. With exhibitions, conferences, and networking opportunities running throughout the day, Day 3 promises to close the event on a high note.

Thursday 06 Nov 2025 / 12:00

SiGMA Central Europe Awards 2025: BetConstruct Wins Innovative Sportsbook Solution of the Year

(Malta).- BetConstruct has been recognised at the SiGMA Central Europe Awards 2025, receiving the Innovative Sportsbook Solution of the Year award. This achievement highlights the company’s continued focus on elevating retail betting experiences and supporting operators with solutions that create measurable business value.

Wednesday 05 Nov 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.